Hedging Strategy Forex

Big hedge funds do it all the time, wall street brokerage There are many financial hedging strategies you can employ as a forex trader.

Do Forex Hedging Strategies Work? Myth About RiskFree Trading

Do Forex Hedging Strategies Work? Myth About RiskFree Trading

In forex, hedging is a very commonly used strategy.

Hedging strategy forex. And all the examples given are terrible, and not strategies at all. This hedging forex strategy is aimed to achieve very high winning rate, while keeping the risk manageable. You just need to know at what time the market moves enough to get the pip profit you want.

Although in some countries this is not supported by traders like us some countries but also the brokers support this strategy. This article will provide you with everything you need to know about hedging, give you an example of a forex hedging strategy, an explanation of the 'hold forex strategy' and more! Let’s take a look at the simplest strategies that traders employ.

So trading from not being secure can cause a lot of problems. Traders, as well as forex robots, deploy the short term protection strategy whenever there is concern that news or upcoming events would lead to adverse events that could trigger losses on an open position. It is super flexible and there are a ton of nuances to this method.

I will share these details with you in later blog posts. To hedge, a trader has to choose two positively correlated pairs like eur/usd and gbp/usd and take opposite directions on both. Hedging means taking a position in order to offset the risk of future price fluctuations.

Forex hedging strategy using two currency pairs. Forex hedges are used by a broad range of market participants. @ there are essentially 3 popular hedging strategies for forex.

This strategy saves the both traders and brokers from the risk and loss. In the double bottom hedging strategy, forex trading instruments and technical traders, reverse the trade set up for the double top hedge. However, i would say that it is better to use the strategy that you are satisfied with.

That’s the reason why this strategy works with hedging. The second hedging strategy is known as the “imperfect strategy,” uses the forex options to safeguard the existing currency pair by creating a temporary hedge. Pairs trading is an advanced forex hedging strategy that involves opening one long position and one short position of two separate currency pairs.

This difficult feat is achieved by hedging at the end of the trend, instead of closing the losing trade at a loss. Pair hedging is a strategy which trades correlated instruments in different directions. For example, a trader can open a long gbp/usd, usd/jpy.

In addition to positively correlated pairs, there can be used currency pairs with. An important forex trading secret is to enter long positions above the neckline once a double bottom occurs. It replaces the usual stop loss and acts as a guarantee of profits.

It is a very common type of financial transaction that. A hedging strategy profitable or not. Option hedging limits downside risk by the use of call or put options.

Hedging forex is a strategy used to protect from losing trades resulting from an adverse move of a currency pair. A simple forex hedging strategy involves opening the opposing position to a current trade. A simple forex hedging strategy involves opening the opposing position to a current trade.

We switch directions of trading upon trend reversal and we will look to close both our existing tr This is done to even out the return profile. The advanced forex hedging strategy is a type of strategy that is some times called stop loss and gain profit technique.

I call my forex hedging strategy zen8. A forex hedge is a transaction implemented to protect an existing or anticipated position from an unwanted move in exchange rates. Options are also one of the cheapest ways to hedge your portfolio.

Forex hedging is a common trading strategy that traders, as well as forex expert advisors, use to offset the risk of price fluctuations in the forex market.unlike other trading strategies such as scalping, trend trading, or positional trading, hedging seeks to reduce unwanted exposure to currencies from other positions. Nowadays, the first method usually involves the opening positions on 3 currency pairs, taking one long and one short position for each currency. Forex trading is a very risky business.

To hedge means to buy and sell at the same time or within a short period, two different instruments either in different markets or in just one market. The forex hedging strategy is used when a party in market trading is going in loss then to convert this lossy movement into profit or for trend change.in simple words we can say that it is used to protect currencies from loss of moeny.this strategy is used for short term trading purpose and can also be used for long term but for both term there are different conditions.this best forex strategy protests traders from loss. This forex hedging strategy will teach you how to trade the market's direction.

Mostly traders use it for estimating the levels of risks that can be. Hedging with forex is a strategy used to protect one's position in a currency pair from an adverse move. Forex hedging is a method which involves opening new positions in the market in order to reduce risk exposure to currency movements.

Hedging is a popular trading strategy deployed to protect opened positions in the forex market from adverse events. In forex options, a trader can select the prices and expiration of a currency pair. Hedging is amongst the most utilized strategies to reduce and manage risk.

How to create a simple profitable hedging strategy. Hedging is defined as an investment position to offset/minimize potential losses/gains. Sadly that is very common in the forex world.

The double bottom chart pattern signals that the downward trend has reversed, and that price is. This strategy is a cinch to undertake, in that it only requires one to open a position going opposite to one’s current position. When the price moves in the market, in most cases there is a possibility of hit stop loss.

The core of my forex hedging strategy.

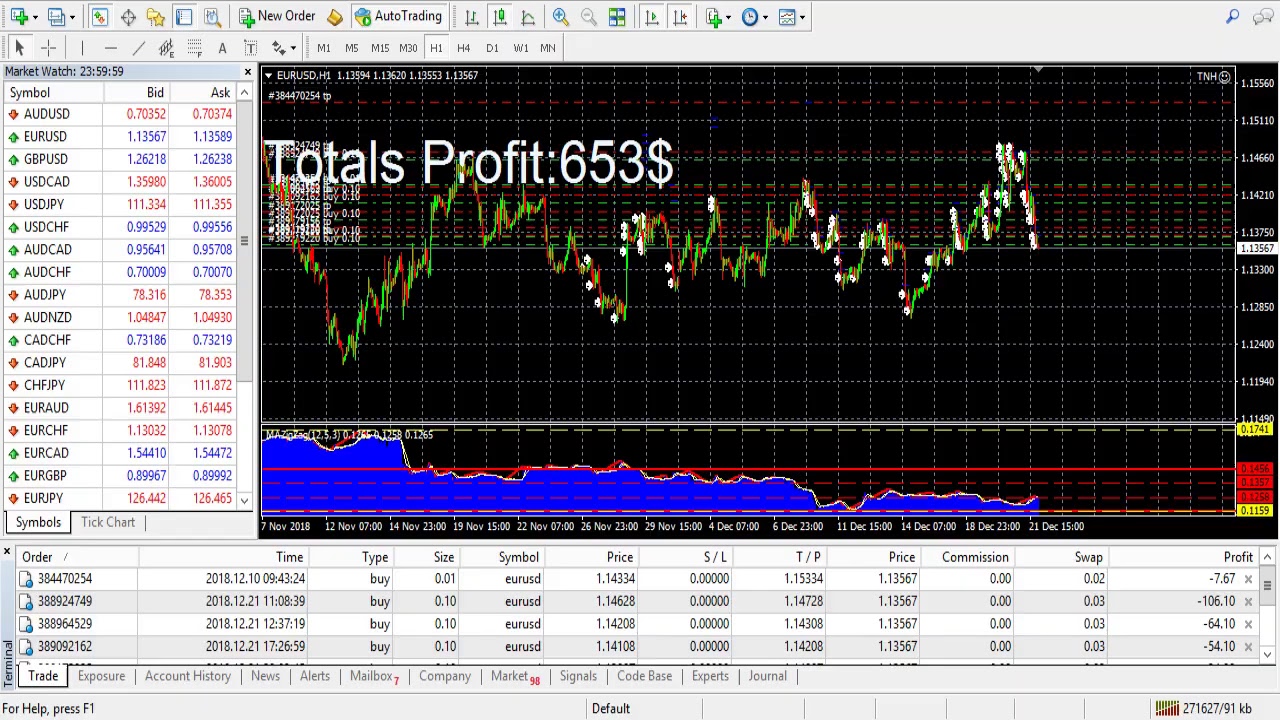

Successful Forex Hedge Strategy that Makes Money YouTube

HEDGING STRATEGY EURUSD/USDX AprilWk3 ForexTrade1

HEDGING STRATEGY EURUSD/USDX AprilWk3 ForexTrade1

Secret forex hedging strategy pdf *

Secret forex hedging strategy pdf *

EA AHG 1.2 Advanced Hedged Grid OL Forex Tips Thailand

EA AHG 1.2 Advanced Hedged Grid OL Forex Tips Thailand

Forex Hedging Dual Grid Strategy Market Neutral Forex

Forex Hedging Dual Grid Strategy Market Neutral Forex

Forex hedging strategy System Signal Scalping YouTube

Forex hedging strategy System Signal Scalping YouTube

HEDGING STRATEGY EURUSD/USDX AprilWk4 ForexTrade1

HEDGING STRATEGY EURUSD/USDX AprilWk4 ForexTrade1

What Is Hedging In Forex With Example

What Is Hedging In Forex With Example

Forex Hedging Strategy Example Forex Success System

Forex Hedging Strategy Example Forex Success System

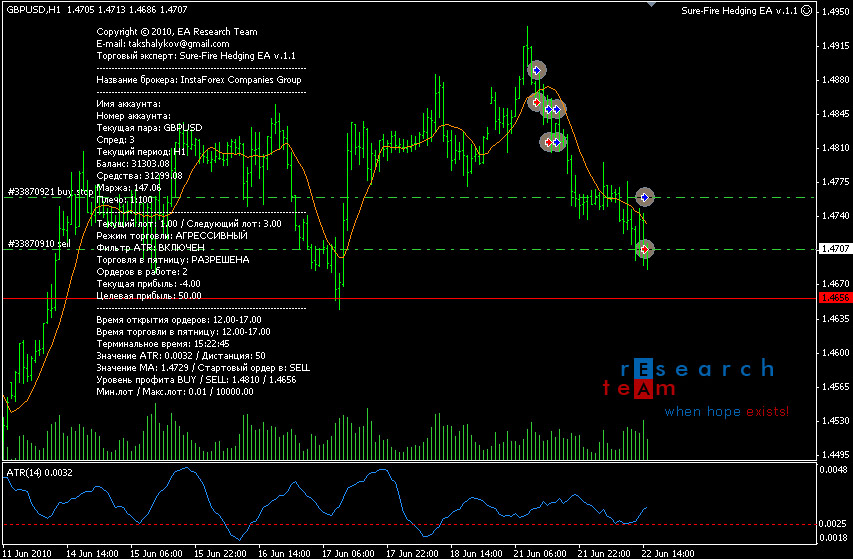

The Sure Fire Forex Hedging Strategy Expert Advisor

The Sure Fire Forex Hedging Strategy Expert Advisor

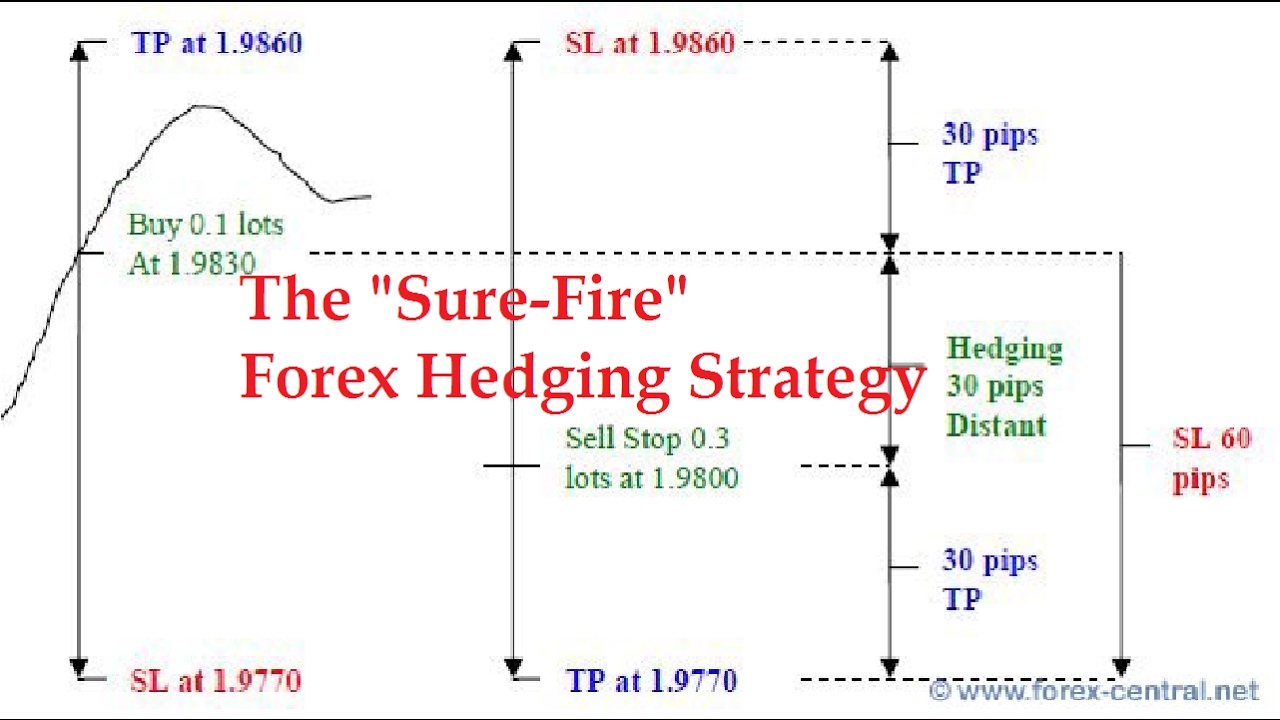

SureFire" Forex Hedging Strategy

SureFire" Forex Hedging Strategy

My Best Forex Hedging Strategy for FX TradingEasy hedging

My Best Forex Hedging Strategy for FX TradingEasy hedging

Hedging my forex positions using binary options trading

The SureFire Forex Hedging Strategy YouTube

The SureFire Forex Hedging Strategy YouTube

Amazing Forex Hedging Strategy 2015

Download Recovery Hedging Ea Forex Free Strategy Download

Forex Hedging Strategy Two Currency Pairs Is The Best

Forex Hedging Strategy Two Currency Pairs Is The Best

FOREX Hedging Strategy presented by a pro trader YouTube

FOREX Hedging Strategy presented by a pro trader YouTube

Forex trading signals living hedging strategy Expert

Forex trading signals living hedging strategy Expert

Comments

Post a Comment